By Daiana Oliveira and Luiza França Pecis

A few months ago, the Brazilian Federal Revenue Service (RFB) published a notice providing guidance to taxpayers on calculating the tax benefit corresponding to presumed ICMS credits granted by states for exclusion from the calculation bases of Corporate Income Tax (IRPJ) and Social Contribution on Net Profit (CSLL).

This marks another chapter in the ongoing discussion about ICMS tax benefits, which, since the beginning of the year, have become subject to the requirements outlined in Law No. 14,789/2023. This law amended Law No. 12,973/2014, which allowed the exclusion of tax benefits from the IRPJ and CSLL calculation bases, provided that, among other requirements, a capital reserve was established. However, according to a precedent set by the Superior Court of Justice (STJ), presumed ICMS credits did not require such a reserve for exclusion.

Given changes in jurisprudential and regulatory landscapes, the Federal Revenue has intensified its efforts to verify compliance with how taxpayers have utilized these benefits, based on the STJ’s jurisprudence and applicable laws at the time of the events. When irregularities are found, the RFB has encouraged taxpayers to self-correct or, in the absence of compliance, has initiated tax assessments for amounts it deems improperly excluded from the IRPJ and CSLL bases.

According to RFB reports, in addition to sending hundreds of compliance alerts, over 80 assessments have been issued, totaling R$8.74 billion in tax credits, with nearly 200 other proceedings still underway.

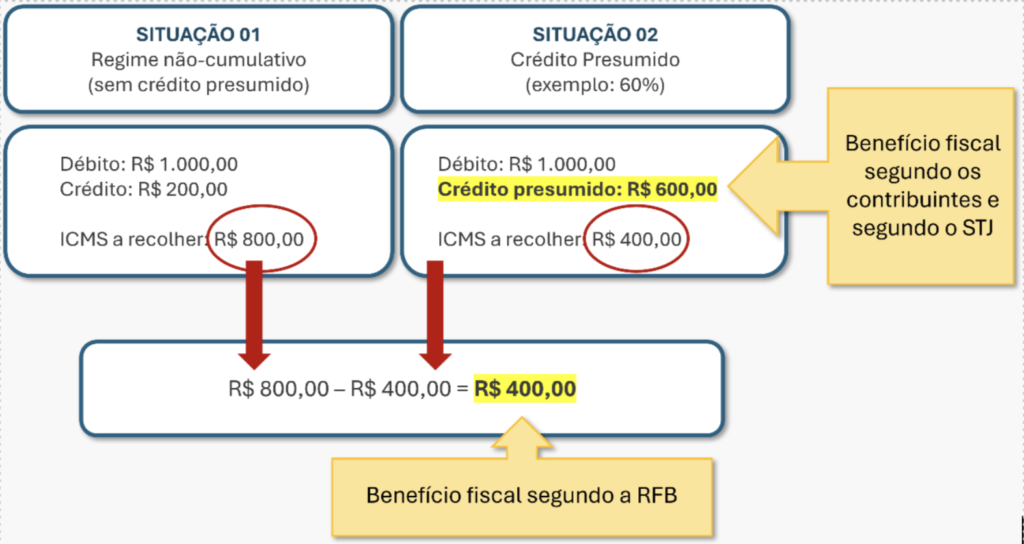

According to the RFB notice, irregularities have been identified where taxpayers allegedly miscalculated the exclusion of presumed ICMS credits from IRPJ and CSLL. The RFB contends that the fiscal benefit eligible for exclusion is not the total presumed ICMS credit calculated and utilized, but rather the difference between the profit calculated without the benefit and the profit calculated with the benefit. This differential, the RFB asserts, represents the actual fiscal benefit eligible for deduction from IRPJ and CSLL.

To clarify this interpretation, the RFB provided an illustrative framework in the notice, showing that the fiscal benefit should reflect the difference between the ICMS amount a taxpayer would have paid under the non-cumulative system and the amount actually paid under the special regime.

In its decision on Repetitive Theme No. 1,182, the STJ analyzed whether jurisprudence on the exclusion of presumed ICMS credits from IRPJ and CSLL calculation bases, based on the federal pact, could be extended to other ICMS tax benefits (such as exemptions, deferrals, reductions in the tax base, among others).

The STJ’s First Section, in its judgment of EREsp No. 1517492/PR, established that presumed ICMS credits do not form part of the IRPJ and CSLL calculation bases. Including these credits in the tax base for these federal taxes would risk undermining or reducing state tax incentives and distort the federal model, which distributes taxation authority among different levels of government.

The court clarified that, for other ICMS tax benefits, taxpayers must meet statutory requirements to avoid IRPJ and CSLL taxation on such benefits. This distinction reinforces that presumed ICMS credits, as per STJ jurisprudence, remain outside the IRPJ and CSLL calculation bases.

Despite the STJ’s established jurisprudence that presumed ICMS credits do not compose the IRPJ and CSLL calculation bases, the RFB’s notice aims to narrow the scope of presumed credits eligible for exclusion from federal tax bases.

This divergence between the RFB’s position and STJ precedents exposes taxpayers to potential tax assessments. However, considering the favorable precedents from the STJ, taxpayers have strong arguments to challenge the new interpretation set forth in the RFB’s recent notice.

The Tax Law Department at Marins Bertoldi Advogados is closely monitoring developments on this matter and is available to clarify any questions and provide tailored guidance based on each company’s specific circumstances.