Recently, Law No. 14.973/2024 was published, regulating the exemption from payroll taxes for the year 2024. To mitigate the effects of this exemption, significant rules have also been implemented that may directly affect the assets of individuals and legal entities.

Among the main innovations introduced are the possibility to update the cost value of real estate already declared by individuals and legal entities to their respective market values, as well as the creation of a new Special General Regularisation Regime for Currency and Tax Assets (RERCT-Geral). This regime follows the same parameters as the RERCT established by Law No. 13.254/2016, allowing taxpayers residing or domiciled in Brazil to voluntarily regularise assets held in the country or abroad, of lawful origin, which have not been declared or have been declared incorrectly.

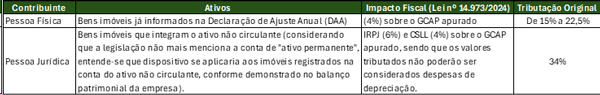

Below, we present the key details of the new rules introduced by Law No. 14.973/2024:

Update of Real Estate Values

Law 14.973/2024 grants taxpayers, temporarily, the opportunity to update the value of their declared real estate for Income Tax purposes to reflect market value. The capital gain, i.e., the positive difference between the originally declared value and the adjusted value, will be taxed under Income Tax at a reduced rate, varying according to the type of taxpayer.

The legislation also establishes specific rules and conditions for calculating capital gains in the event of a sale of these assets within 15 years of the update. In such cases, a proportional capital gain must be collected, with progressive reduction percentages based on the length of ownership following the update.

Taxpayers have a period of 90 days to opt for the update of real estate values.

Before proceeding with the update, it is advisable to analyse the purpose of each property, the anticipated time frame and value for its sale, the acquisition date, among other factors. This will allow for a more accurate assessment to determine if the update is advantageous at this time.

Special General Regularisation Regime (RERCT)

The new Special General Regularisation Regime for Currency and Tax Assets (RERCT-Geral) follows the same principles as Law No. 13.254/2016.

The RERCT-Geral allows for the voluntary declaration of resources, assets, or rights of lawful origin that have not been declared or have been declared incorrectly or incompletely, both in Brazil and abroad, or that have been repatriated by residents or domiciled in the country.

The deadline for adherence is 90 days from the publication of the law, requiring the submission of a voluntary declaration of the assets held as of 31 December 2023, along with the payment of tax and penalties.

To adhere, the individual or legal entity must submit a Regularisation Declaration (DERCAT) to the Special Secretariat of the Federal Revenue of Brazil, detailing the resources, assets, and rights held as of 31 December 2023, along with their respective values in Brazilian reais.

In addition to the DERCAT, the taxpayer must pay Income Tax on the capital gain at a rate of 15%, calculated based on the value of the assets in foreign currency, converted into reais at the exchange rate of the Central Bank of Brazil on 31 December 2023.

If all conditions are met, the tax credits owed to the tax authorities (resulting from non-compliance with tax obligations) will be forgiven, and there will be a total reduction of 100% in late penalties.

Taxpayers who adhered to the RERCT in 2016 will have the option to supplement the original declaration to include assets or rights acquired after that date, in accordance with the rules of the new Law No. 14.973/2024.

The tax authority will also publish detailed regulations outlining the deadlines and procedures to comply with the requirements established by the law. Therefore, it is up to the taxpayer to evaluate the relevance of updating their real estate assets and adhering to the RERCT-Geral, considering the provisions of this new legislation.

The Tax Team at Marins Bertoldi Advogados is closely monitoring developments on this subject and is fully available to address any questions and provide in-depth analysis tailored to each situation.

By Ana Caroline Ferreira